What Are Medicare Supplement Plans?

Medicare Supplement Plans AKA "Medigap" just like Medicare Advantage Plans are also offered by private insurance companies. These companies are contracted by Medicare to provide all services covered by traditional Medicare and follow the rules set by Medicare. Individuals who can afford paying a monthly premium, can enroll in Medicare Supplement plans if they have Medicare Part A and Part B benefits.

On top of the monthly premium, additional premium for prescription drugs (Part D) must be paid to enroll in Medicare Supplement plans because these plans to do not cover prescriptions. These plans will give you the freedom to see any participating Medicare provider, and will cover most deductibles that are included in the traditional or original medicare.

Medicare Supplement Plan Types

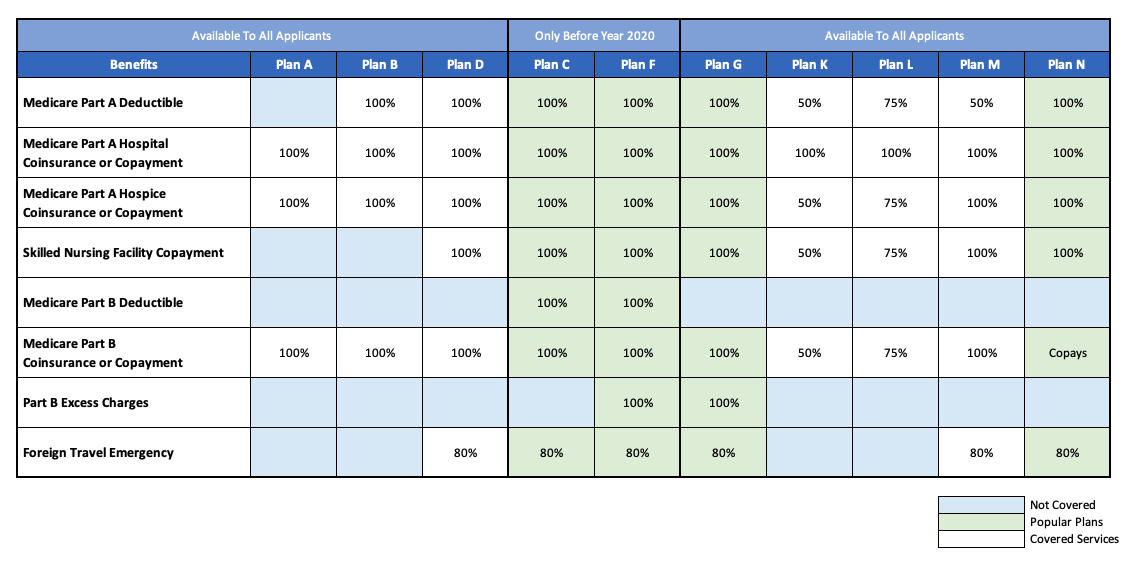

Below is a breakdown of the ten plans offered by Medicare Supplement or Medigap carriers. These plans are standard across all carriers but prices vary. It is important to do your research and get the best prices since all carriers offer the same benefits. From the chart below, you can see that plans; C, F, G and N are very popular and cover the most, their cost is also higher than the rest. Plans F and G also offer additional high deductible plans which cover 100% of services after the deductibles are met.

It is important to note that plan C and plan F are no longer available for applicants who became eligible for Medicare after year 2020. Call us to learn more about these plans including the high deductible plans.

Medicare Supplements Enrollment Period

Medicare Supplement Open Enrollment Period begins the first day of the month in which you are both age 65 or older and enrolled in Medicare Part B. This period only lasts for 6 months. Enrolling after this period will trigger the plan provider to check your medical history to determine cost and eligibility. To avoid underwriting you must have guarantee issue rights.

Guarantee Issue Rights for Medicare Supplements Plans

Guarantee issue rights allows qualified individuals to enroll in Medicare Supplement plans at any time without being subjected to medical underwriting or premium increase.

Here are some of the common examples that may trigger guarantee issue:

- Transitioning from an employer-based plan to Medicare Supplement plans.

- Loss of coverage in your service area.

- Disruption of coverage from a Medicare Supplement plan provider.

- Switching from Medicare Advantage and back to Medicare Supplement plan within a year.

When Can I Change Medicare Supplement Plans?

You can change your plan to a different Medicare Supplement plan at any time. However, if you don't qualify for guaranteed issue rights, the plan provider may decide to have you go through medical underwriting to check your health status. This may determine how much you'll be charged for the plan.

Understanding Medicare and Enrollment Help

As you can see, understanding all these Medicare Supplement plans and enrollment rules can be confusing and complex, which is why our agents at Limeret insurance services are always ready to help you figure all this out at no cost. We always look forward to working with seniors living in these states; California, Arizona, Texas, Pennsylvania, Ohio, Michigan, North Carolina and Florida.